Tax and Revenue Stamp Solutions

What We Do

Secure your supply chain with tax and revenue stamps. Many governments are losing revenue in the millions each year to illicit trade of tobacco, alcohol and pharmaceutical products. Once products are manufactured in one country and cross international borders to be consumed in another country, the opportunities for revenue evasion are considerable. Tax stamp security is an essential component of government revenue protection.

Authentix offers tax stamp security technologies that can support a variety of tax stamp programs such as:

- Traditional programs relying upon basic secure tax stamps

- Digital excise tax recovery programs where a unique, encrypted code is printed directly onto the item

- Hybrid tax stamp programs where a tax stamp contains an encrypted barcode in addition to a collection of overt and covert security features

Digital markings and hybrid stamps provide tracking information which enables an efficient collection of excise taxes. At the heart of these programs is the Authentix TransAct™ digital tax stamp solution which collects the data provided by enforcement agents and approved manufacturers.

How Our Tax & Revenue Stamp Solutions Work

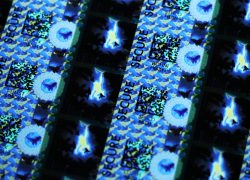

Paper stamps are traditionally-applied labels enhanced with covert markers. Authentix is able to incorporate its machine readable covert features, forensic features, overt security materials, and encrypted bar code solutions into any of these tax stamp program approaches.

Authentix tax and revenue stamps are integrated with a track and trace solution that enables online and offline verification and supply chain monitoring. Our stamps feature a complex, layered security design with up to 25 different security features including multi-factor authentication.

TAX STAMP CASE STUDY LEARN MORE ABOUT TRANSACT™

Benefits

- Track and trace is designed to monitor the secure movement of goods throughout the supply chain. Governments can meet their obligations under the WHO FCTC Protocol on the Illicit Trade in Tobacco Products.

- Verification of the stated volume of products manufactured to establish the excise tax due.

- Authentication is achieved using over 30 covert and overt identifiers on each individual stamp to help consumers and government inspectors determine genuine products from counterfeits.

Protect Your Revenue with Tax Stamp Security Solutions

If you’re ready to learn more about how tax and revenue stamps can help secure your supply chain and protect your revenue, contact Authentix today! Our tax stamp security experts will help you determine the best solution for your unique situation.

Contact Us

GET IN TOUCH WITH US